Is it better to buy or rent a property? This is a question that many Canadians ask themselves before entering the housing market. Homeownership can be advantageous in several ways. An owner has more stability and flexibility than a renter, as there is no landlord imposing restrictions or timelines. There are also financial benefits to owning your own home. In an effort to better understand the long-term financial advantages of buying versus renting, Royal LePage sponsored research by Will Dunning, an independent and well-known economist who has specialized in housing market research since 1982 (full report).

The research report compares the costs of owning and renting in four different ways:

• Using the most recent data, what does the comparison show for the cost of owning a home versus renting the same dwelling?

• Looking backward: during the recent past, what have been the initial (first-month) costs of buying a home versus renting a similar dwelling, and how has that evolved over time?

• Looking forward: for someone buying a home now, how might the costs of homeownership compare to the costs of renting the same dwelling during the coming decade?

• Then, for that 10-year period (at which time the dwelling would be sold), how might homeownership perform if it is looked at as an investment?

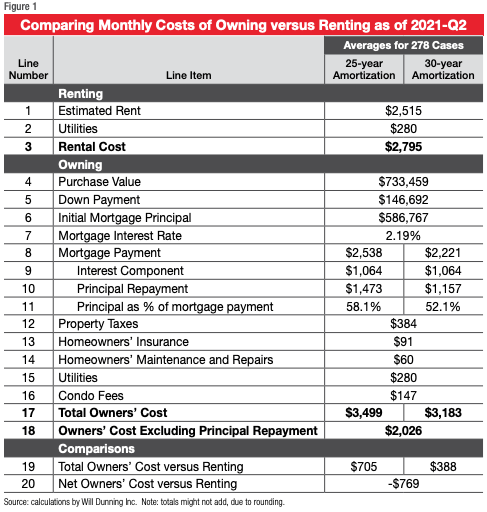

Using 278 case studies (including seven different types of dwelling, across six provinces of Canada), the report contains a comparative analysis of current and recent first-month cost scenarios. In these calculations, it is assumed that the homebuyer makes a 20% down payment and the initial mortgage is equal to 80% of the value of the home.

• When mortgage costs are based on a 25-year amortization period, ownership costs are higher than rental costs for220 out of 278 cases, or 79%. The average gap is quite large. In the first month, it averages $705 (based on a total ownership cost of $3,499 per month versus a rental cost of $2,795). • Based on a 30-year amortization, the costs of ownership are reduced (averaging $3,183 versus the rent of $2,795), and therefore the gap is smaller, at $388 in the first month. In this scenario, the cost of ownership exceeds the cost of renting for 191 of the 278 cases (69%).

But, there is a further consideration: the mortgage payment includes repayment of principal. Based on a 25-year amortization, in the first month, the average repayment for the 278 cases is $1,473 (the amount is smaller with a 30-year amortization, at $1,157). While the homeowner has to make the complete payment, the principal repayment component isn’t really a cost, it is a form of saving (which we often think of as “forced saving”). The homeowner can calculate a “net cost” (which takes out the amount of principal repayment).

On average, across the 278 cases, the net cost of ownership is $2,026 in the first month, which is $769 less than the cost of renting.

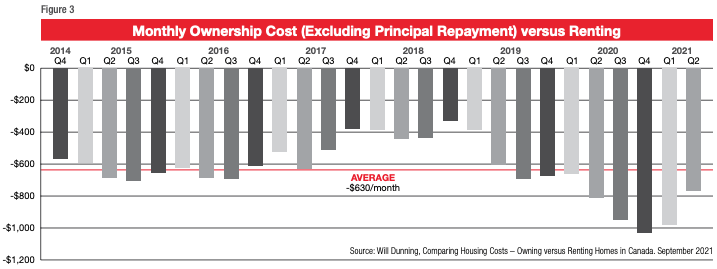

Out of 278 cases, the net cost of owning is lower than the cost of renting in 253 cases (91%), and renting is less costly in only 25 (9%) of the cases. The difference between net ownership costs and renting in this report is referred to as “ownership advantage” (see Figure 3). Based on these calculations, homeownership starts to make sense financially. But, the total cost of ownership is still quite challenging, due to the very large amounts of forced saving that are required. Moreover, the very large required down payments are challenging. However, for those who have the funds to purchase, the overwhelming majority will find a long-term financial advantage.

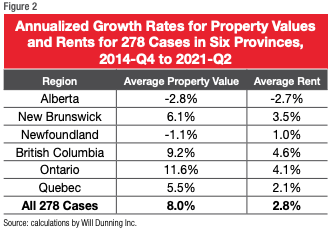

During the analysis period, home values increased substantially

more rapidly than rents for most of the cases, as is shown in

Figure 2. However, interest rates also fell during the period,

which largely offset the impact of rising values. Consequently, the costs of owning have remained attractive compared to renting.

The Home Ownership Advantage

There are many reasons why home ownership has serious appeal. A significant one is that the cost of home ownership has been

considerably lower than the cost of renting over time when you look at the costs on a net basis.

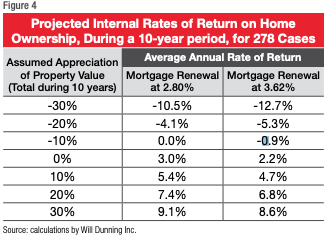

But what about future scenarios? The report creates scenarios for housing costs during a 10-year period for homes purchased in Q2 2021. In these projections, most of the costs are assumed to increase by 2.5% per year. Mortgage payments, of course, are not automatically inflated. In this analysis, it is assumed that the initial term is five years, and then the mortgages are renewed at either 2.80% (the average of Will Dunning’s “opinion-estimates” of typical rates for 2014-Q4 until 2021-Q2) or 3.62% (which was the highest opinion-estimate during that period).

In all of these scenarios, home ownership is projected to become increasingly advantageous over time.

The result of fixed mortgage payments is that during the initial term of the mortgage, the total cost of ownership rises more slowly than the rent, and home ownership becomes increasingly advantageous. The result of fixed mortgage payments is that during the initial term of the mortgage, the total cost of ownership rises more slowly than the rent, and home ownership becomes increasingly advantageous. The scenarios calculate that renewal of the mortgage at a higher interest rate would be a temporary setback, but without materially changing the long-term benefit of home ownership.

In order to purchase, buyers invest considerable amounts of capital in home ownership, including the down payments, closing costs, and then the amounts by which total monthly costs exceed the cost of renting. Sometimes it is argued that people would be better off by investing that capital in other ways. In the report, this is investigated by calculating rates of return for invested capital for each of the 278 cases for the coming 10-years.

These projections indicate that even with price drops of 10%, about one-half of the 278 cases would break-even as investments, and with no growth of home values, most purchases would generate a positive rate of return on investment. Home ownership can be justified financially without making aggressive assumptions about future growth of values.

These estimates indicate that if homebuyers choose to assess their purchases as investments, many buyers would be able to justify the decision using moderate assumptions about future changes in value: a decision to buy a home does not require aggressive assumptions.

About the data and assumptions used

The dataset provides estimates of “fair market value”, market rents, and property taxes, for communities across Canada, for seven

different house types. It provides 278 different combinations (“cases”) of locations and types of dwellings, for which all three data

elements are available. The distribution of the sample (by province and dwelling type), is summarized in the Appendix, in Table A-4

of the full report. In addition to this dataset, estimates are employed for other components of housing costs (utilities, repairs by

homeowners, homeowners’ insurance, and condominium fees). These cost factors were derived via analysis of Statistics Canada data

on consumer spending. All of these cost factors have been updated, using data on inflation and housing market data from various

sources. In addition, analysis of ownership costs includes calculations of mortgage costs, using my estimates of typical “special offer”

interest rates that are advertised by major lenders (for 5-year fixed-rate mortgages – lower interest rates can often be negotiated).

Conservative assumptions are made in the report that aligns with current and historical trends. For specific data and assumptions

used in each model, the reader is encouraged to read the full report which can be found here: rlp.ca/rent-vs-buy-rep